Performance First Ultimate Protection

Protection From Unexpected Repair Bills

If you’re looking for the very best vehicle repair coverage, you have it with Performance First Ultimate.

Benefits

(No deductible applies to these benefits.)

- Towing Benefit—Up to $100 per covered breakdown.

- Rental Benefit—Up to $40 per day, up to five days for each covered repair visit, with five additional days of rental or for parts and/or inspection delays.

- Trip Interruption—Up to $125 per day for a maximum of three days per occurrence for meals and lodging.

- Lockout Service—Up to $50 per occurrence for locksmith services when keys are broken or accidentally locked in the vehicle.

- Road Service—Up to $100 per occurrence for on-site assistance for vehicle extrication, fuel or fluid delivery, or battery boost/jump (excludes cost of fluids or fuel).

Perks

- Day-One Coverage—Performance First Ultimate coverage starts the day you purchase your vehicle and service contract.

- Transferable—When it comes time for you to sell your vehicle, if the buyer is a private party, you can transfer the service contract to them, making your vehicle more attractive to buyers.

This exclusionary service contract offers the very best protection for your new vehicle. When you purchase Performance First Ultimate, the cost for the breakdown and the wear and tear of any of the vehicle’s components will be covered, including the seals and gaskets.

Coverage Details

The Best Protection

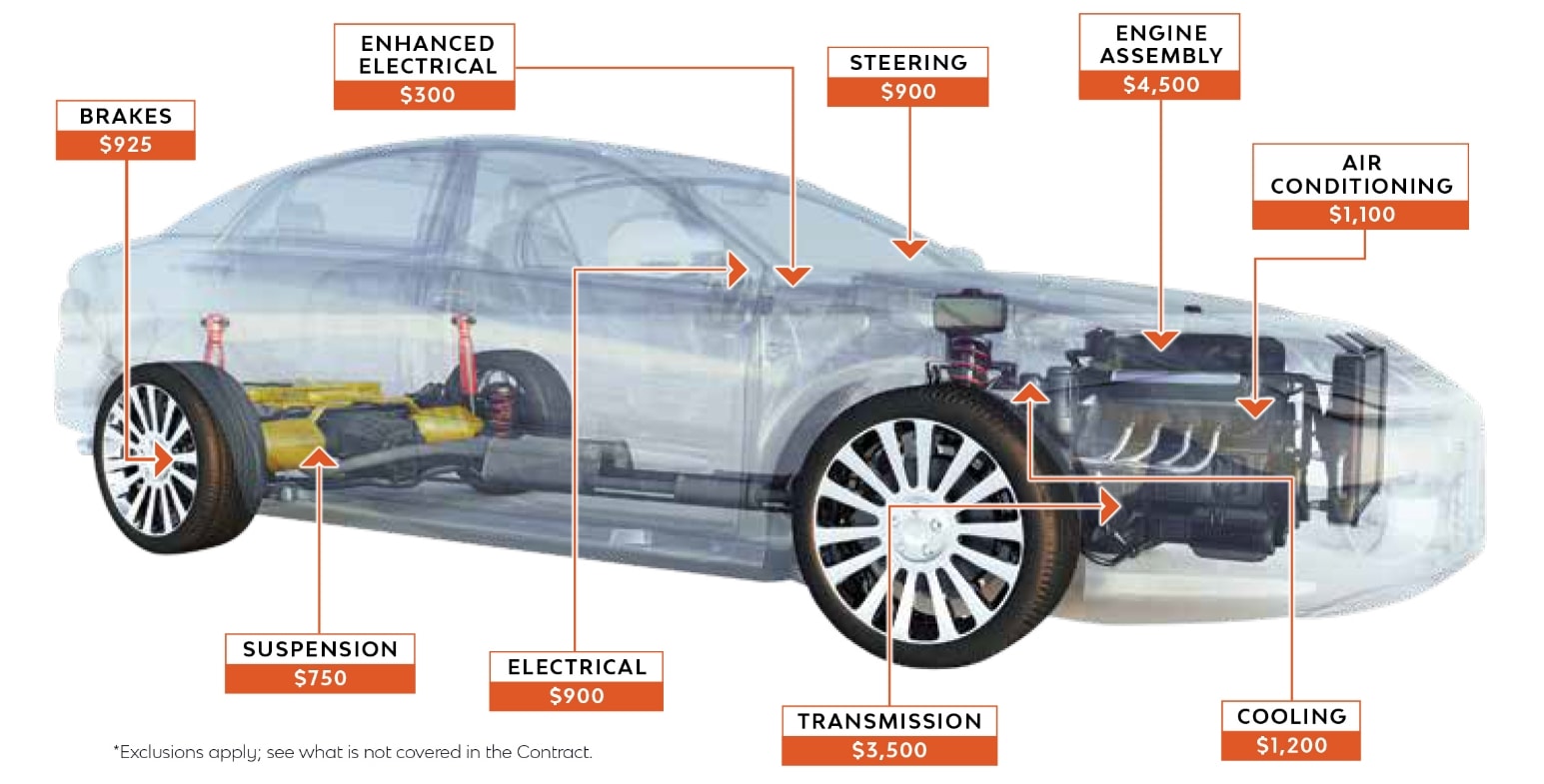

Get protected from unexpected vehicle repair bills with Performance First Ultimate coverage (sample repair costs shown).

Performance First Image Guard is administered by Scioto Administrators Corporation, a subsidiary of Renascent Protection Solutions.

Some coverages are not available with certain lienholders. Please see contracts for details.

This page is not a contract and programs are subject to change. Complete details, terms, and conditions are in the Service Contract and should be reviewed. Contracts are underwritten by A.M. Best “A” rated insurers. Some benefits are not allowed in some states—these benefits would be excluded from coverage.